401k to roth 401k conversion calculator

Ad Open an IRA Explore Roth vs. The Roth IRA conversion and designated Roth 401k conversion media storm is in full swing.

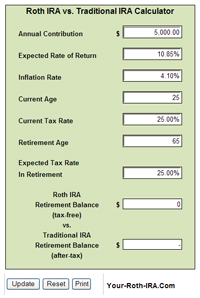

Traditional Vs Roth Ira Calculator

Make a Thoughtful Decision For Your Retirement.

. This calculator will show the advantage if any of converting your pre-tax 401k to a Roth 401k. Your IRA could decrease 2138 with a Roth. Strong Retirement Benefits Help You Attract Retain Talent.

This calculator can help you make informed decisions about performing a Roth conversion in 2022. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Ad Find Out If A Roth IRA Conversion Is For You.

A conversion has both advantages and disadvantages that should be carefully considered before you make a decision. Roth Conversion Calculator Methodology General Context. With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert existing pre-tax 401 k.

Contributions to a Traditional 401 k or individual retirement accounts are made on a pre-tax basis resulting in a lower tax bill and higher take-home pay. 19500 or 26000 in 2021 or 20500 in 2022 with the 6500 catch-up amount. Roth IRA Conversion Calculator Use this calculator to compare the projected after-tax value of your Traditional IRA or 401k to the.

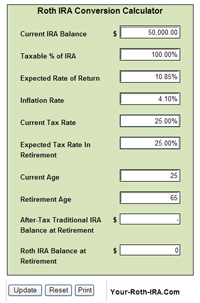

This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA. Additional Roth Ira Calculators. This calculator compares two alternatives with equal out of pocket costs.

The Sooner You Invest the More Opportunity Your Money Has To Grow. A conversion has both advantages and disadvantages that should be carefully considered before you make a decision. A conversion has both advantages and disadvantages that should be carefully considered before you make a decision.

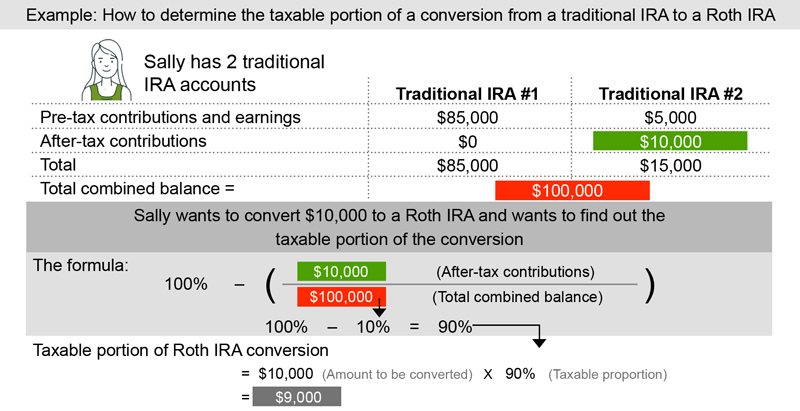

Expected Federal Income Tax Rate at RetirementBased on your income at retirement the amount of federal income taxes you expect to pay at retirement as compared to your current federal. The contribution limits on a Roth 401 k are the same as those for a traditional 401 k. A backdoor Roth 401 k conversion is the transfer of both the pretax and after-tax contributions in a regular 401 k account to an employer-designated Roth 401 k account.

This calculator will demonstrate the difference between taking a lump-sum payment from your 401 k and saving it in a tax-deferred account until retirement. A conversion has both advantages and disadvantages that should be carefully considered before you make a decision. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

However you pay for these benefits upfront. So Roth conversions give you tax free withdrawals and growth with fewer rules. Traditional vs Roth Calculator.

The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. Explore The Advantages of Moving an IRA to Fidelity. Roth 401 k contributions allow.

Explore The Advantages of Moving an IRA to Fidelity. Ad Roll Over Existing IRA Accounts and Manage Your Fidelity Account Today. Traditional or Rollover Your 401k Today.

For some investors this could prove. Protect Yourself From Inflation. Ad Roll Over Into a TIAA Roth IRA Get a Clearer View Of Your Financial Picture.

Schwab Is Here To Answer Your Questions And Help You Through The Process. Use the tool to compare estimated taxes when you do. 401k IRA Rollover Calculator.

Reasons to Do a Roth Conversion Right Now. 10 Best Companies to Rollover Your 401K into a Gold IRA. As of January 2006 there is a new type of 401 k contribution.

Take Advantage Of The After-Tax Benefits. For some converting traditional retirement account assets into Roth accounts can. Roth IRA Conversion Calculator Use this Roth IRA conversion calculator to project the inflation-adjusted after-tax value of your Traditional IRA or 401k at retirement versus the inflation.

Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You. This calculator compares two alternatives with equal out of pocket costs.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. With the passage of the American Tax Relief Act any 401k plan that allows for Roth. Roth 401 k Conversion Calculator.

2022 Roth Conversion Calculator. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. This calculator compares two alternatives with equal out of pocket.

This calculator compares two alternatives with equal out of pocket costs. Ad Roll Over Existing IRA Accounts and Manage Your Fidelity Account Today. Traditional 401 k and your Paycheck.

A 401 k can be an effective retirement tool.

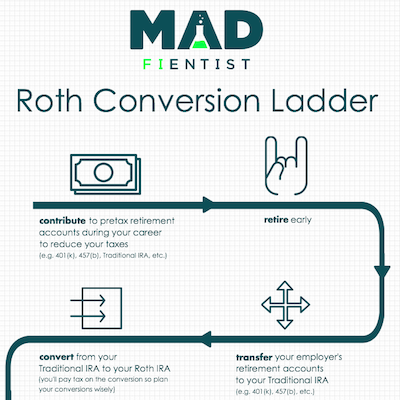

How To Access Retirement Funds Early

Traditional Vs Roth Ira Calculator

Understanding The Mega Backdoor Roth Ira

Roth Ira Calculators

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

The Ultimate Roth 401 K Guide District Capital Management

How To Access Retirement Funds Early

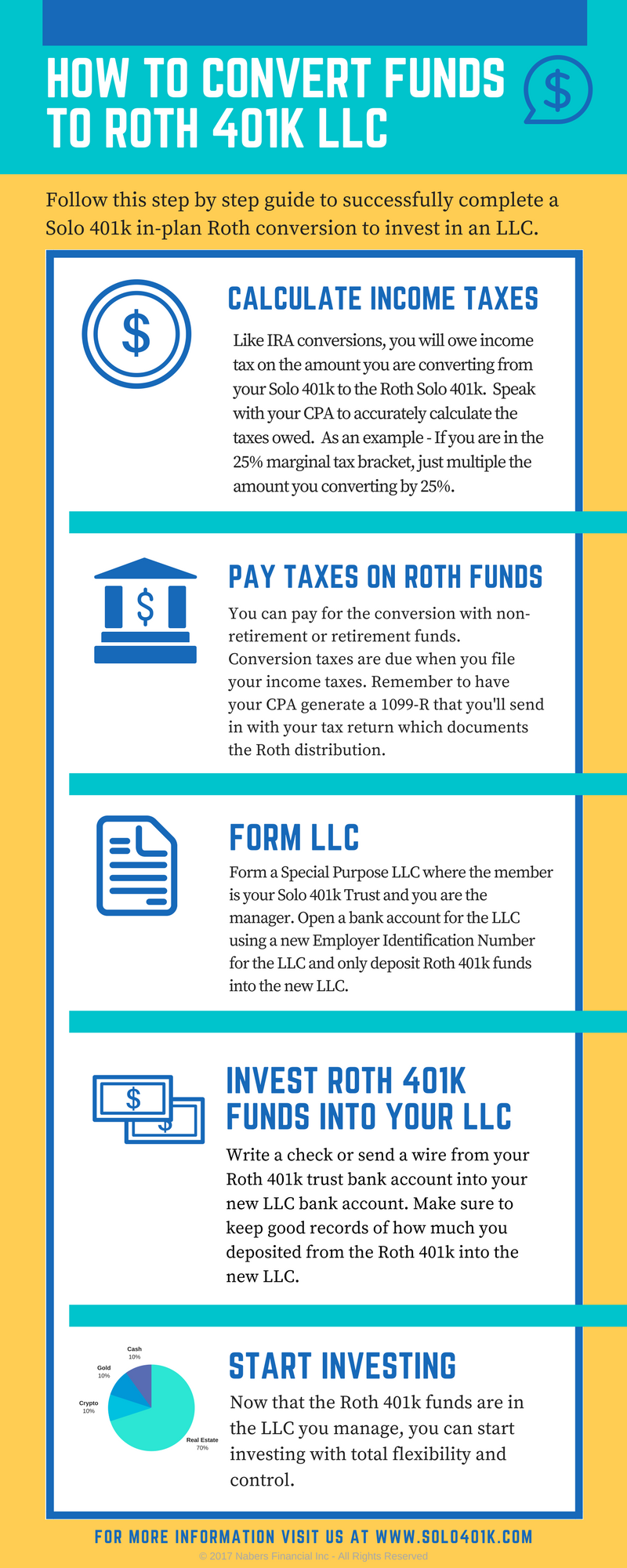

Infographic Converting To A Roth 401k Llc Solo 401k

How To File Irs Form 1099 R Solo 401k

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculators

401 K Vs Roth 401 K Calculator Which One Should You Invest In The Kickass Entrepreneur

Roth Ira Conversion Ameriprise Financial

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Conversion Q A Fidelity