45+ where to put mortgage interest on tax return

1 million if the loan was finalized on or before Dec. Leading Federal Tax Law Reference Guide.

Ex 99 1

The entry would be made by selecting.

. Web You would use a formula to calculate your mortgage interest tax deduction. Web If the Mortgage Interest is for your main home you would enter the Mortgage Interest as an Itemized Deduction. This form reports the total interest you paid during the previous year if it exceeds 600.

You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. It can take the IRS up to 12 weeks or longer to process them. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund.

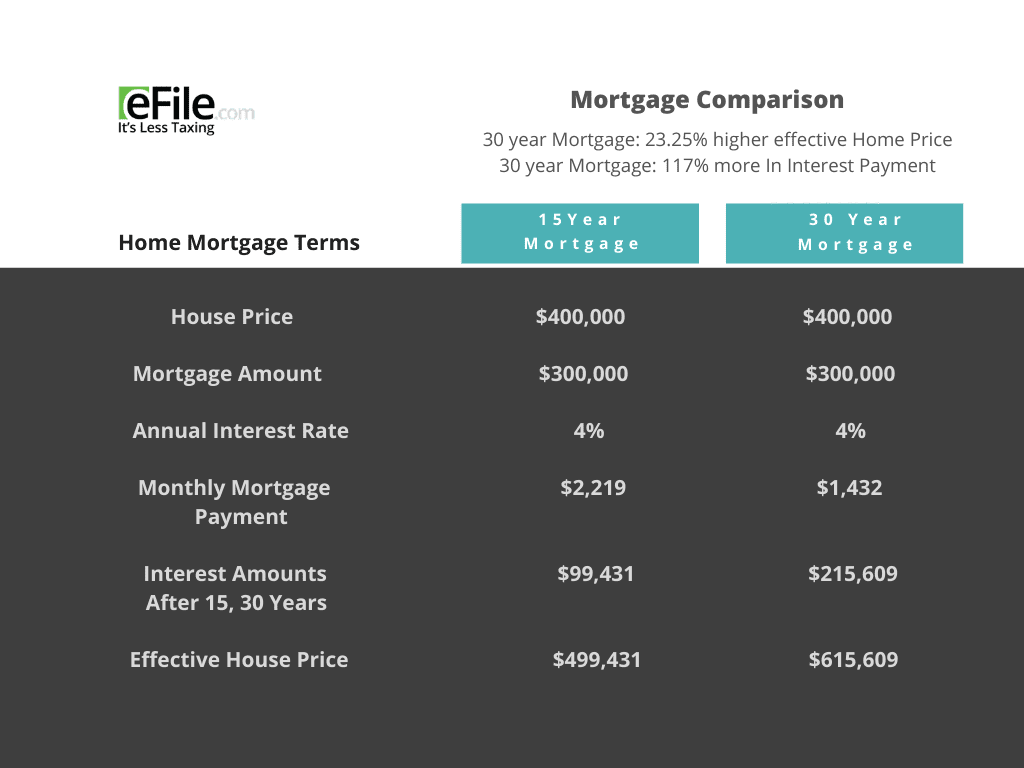

Web Your federal tax return from last year if you refinanced your mortgage last year or earlier and if youre deducting the eligible portion of your interest over the life of your mortgage. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Web Used to buy build or improve your main or second home and.

Current Revision Form 1098 PDF Instructions for Form 1098 Print Version PDF Recent Developments None at this time. TurboTax Makes Filing Tax Returns Easy With Simple Step-By-Step Instructions. Backed by our Full Service Guarantee.

The tool is designed for taxpayers who were US. For taxpayers who use married filing separate status the. 6 Often Overlooked Tax Breaks You Dont Want to Miss.

Discover How HR Block Makes It Easier to File Your Way. In some cases though calculating and deducting mortgage points can be tricky. Web If a lump sum amount was paid to reduce the interest rate on a mortgage only a pro-rated portion of that lump sum is deductible in the tax year it was paid.

This gives you 05 which you multiply by the total. These must be charged for the general public interest. Note that if you are renting out part of your principal residence you are only eligible to claim a portion of the mortgage interest.

Real estate taxes you can deduct are usually any state local or foreign taxes on real property. 750000 if the loan was finalized after Dec. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Other Items You May. File Online or In-Person Today.

If any of your points were not included on Form 1098 enter the additional amount you paid on line 8c of Form 1040 Schedule A. Web If you paid real estate taxes through an escrow account you can only deduct the amount that was actually paid. Your mortgage lender sends you a Form 1098 in January or early.

Web Determining How Much Interest You Paid on Your Mortgage You should receive Form 1098 the Mortgage Interest Statement from your mortgage lender after the close of the tax year typically in January. Beginning in 2018 the limitation for the amount of home mortgage interest is limited to the first 750000 375000 for married filing separate of indebtedness. Web Amended returns have to be printed and filed by mail.

Web If you are charging 10000 in rent for your property and are being charged 9000 in mortgage interest then you will be taxed on the full 10000 income depending on your personal tax bracket. Get Your Max Refund Guaranteed. Web Transfer this amount to line 8a of Form 1040 Schedule A.

Ad Includes All Federal Taxation Changes That Affect 2021 Returns. TurboTax Makes Filing Tax Returns Easy With Simple Step-By-Step Instructions. Fast Reliable Answers.

To the taxing authority. In this example you divide the loan limit 750000 by the balance of your mortgage 1500000. If you are due a larger refund than on your original return your amended return should only show the difference and you will receive a separate check for it.

Look in your mailbox for Form 1098. Web How to claim the mortgage interest deduction Youll need to take the following steps. After this has been paid then you are able to claim back a 20 tax credit on the mortgage interest.

For many taxpayers the process really is this simple. Citizens or resident aliens for the entire tax year for which theyre inquiring. Out of the account.

Web Form 1098 is a form filed with the Internal Revenue Service IRS that details the amount of interest and mortgage-related expenses paid on a mortgage during the tax year. Secured by that home. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

With TurboTax Live Full Service Deluxe a tax expert will do your taxes for you and find every dollar you deserve. Learn More at AARP. Ad Dont Leave Money On The Table with HR Block.

These expenses can be. Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an individual including a sole proprietor.

Home Mortgage Loan Interest Payments Points Deduction

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

Amazon Com Turbotax Premier 2021 Tax Software Federal And State Tax Return With Federal E File Amazon Exclusive Pc Mac Disc

Kingdom Of The Netherlands In Imf Staff Country Reports Volume 2008 Issue 171 2008

Home Mortgage Loan Interest Payments Points Deduction

Mortgage Interest Deduction And Your Tax Partner What If Your Partner Leaves

Sec Filing Avantax

Faq 2022 Bond Aransas Co Independent School District

More Inverted Home Loan Rate Offers Interest Co Nz

Private Money Lender Credibility Packet

Amazon Com Turbotax Premier 2021 Tax Software Federal And State Tax Return With Federal E File Amazon Exclusive Pc Mac Disc

Do You Get All Your Interest On Your Mortgage Back On Taxes

Kaiserslautern American July 4 2013 By Advantipro Gmbh Issuu

Distribution Of Hew Type Among Older Home Owner Households Who Engaged Download Scientific Diagram

How To Apply For The German Freelance Visa All About Berlin

18 Commonly Missed Small Business Tax Write Offs Shoeboxed

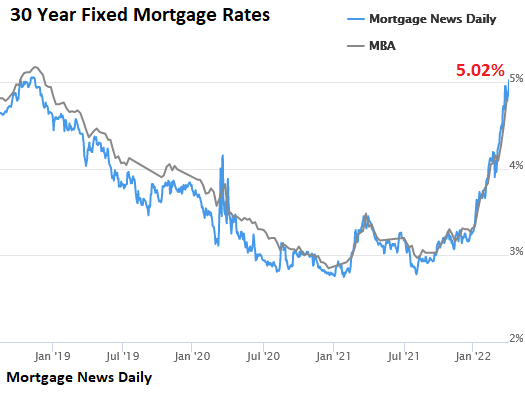

Mortgage Rates Breach 5 Two Year 10 Year Treasury Yields Spike After Fed Dove Brainard Explains How Inflation Is Much Worse For Lower Income Households Than Cpi Shows Wolf Street